13. Tax Smoothing#

13.1. Overview#

This is a sister lecture to our lecture on consumption-smoothing.

By renaming variables, we obtain a version of a model “tax-smoothing model” that Robert Barro [Barro, 1979] used to explain why governments sometimes choose not to balance their budgets every period but instead use issue debt to smooth tax rates over time.

The government chooses a tax collection path that minimizes the present value of its costs of raising revenue.

The government minimizes those costs by smoothing tax collections over time and by issuing government debt during temporary surges in government expenditures.

The present value of government expenditures is at the core of the tax-smoothing model, so we’ll again use formulas presented in present value formulas.

We’ll again use the matrix multiplication and matrix inversion tools that we used in present value formulas.

13.2. Analysis#

As usual, we’ll start by importing some Python modules.

import numpy as np

import matplotlib.pyplot as plt

from collections import namedtuple

A government exists at times

It chooses chooses a stream of tax collections

The model takes a government expenditure stream as an “exogenous” input that is somehow determined outside the model.

The government faces a gross interest rate of

The government can borrow or lend at interest rate

Let

The sequence of government debt

We require it to satisfy two boundary conditions:

it must equal an exogenous value

it must equal or exceed an exogenous value

The terminal condition

(This no-Ponzi condition ensures that the government ultimately pays off its debts – it can’t simply roll them over indefinitely.)

The government faces a sequence of budget constraints that constrain sequences

Equations (13.1) constitute

Given a sequence

The model follows the following logical flow:

start with an exogenous government expenditure sequence

use the system of equations (13.1) for

verify that

If it does, declare that the candidate path is budget feasible.

if the candidate tax path is not budget feasible, propose a different tax path and start over

Below, we’ll describe how to execute these steps using linear algebra – matrix inversion and multiplication.

The above procedure seems like a sensible way to find “budget-feasible” tax paths

In general, there are many budget feasible tax paths

Among all budget-feasible tax paths, which one should a government choose?

To answer this question, we assess alternative budget feasible tax paths

where

This is called the “present value of revenue-raising costs” in [Barro, 1979].

The quadratic term

This creates an incentive for tax smoothing.

Indeed, we shall see that when

By smoother we mean tax rates that are as close as possible to being constant over time.

The preference for smooth tax paths that is built into the model gives it the name “tax-smoothing model”.

Or equivalently, we can transform this into the same problem as in the consumption-smoothing lecture by maximizing the welfare criterion:

Let’s dive in and do some calculations that will help us understand how the model works.

Here we use default parameters

We create a Python namedtuple to store these parameters with default values.

TaxSmoothing = namedtuple("TaxSmoothing",

["R", "g1", "g2", "β_seq", "S"])

def create_tax_smoothing_model(R=1.01, g1=1, g2=1/2, S=65):

"""

Creates an instance of the tax smoothing model.

"""

β = 1/R

β_seq = np.array([β**i for i in range(S+1)])

return TaxSmoothing(R, g1, g2, β_seq, S)

13.3. Barro tax-smoothing model#

A key object is the present value of government expenditures at time

This sum represents the present value of all future government expenditures that must be financed.

Formally it resembles the present value calculations we saw in this QuantEcon lecture present values.

This present value calculation is crucial for determining the government’s total financing needs.

By iterating on equation (13.1) and imposing the terminal condition

it is possible to convert a sequence of budget constraints (13.1) into a single intertemporal constraint

Equation (13.4) says that the present value of tax collections must equal the sum of initial debt and the present value of government expenditures.

When

(Later we’ll present a “variational argument” that shows that this constant path minimizes

criterion (13.2) and maximizes (13.3) when

In this case, we can use the intertemporal budget constraint to write

Equation (13.5) is the tax-smoothing model in a nutshell.

13.4. Mechanics of tax-smoothing#

As promised, we’ll provide step-by-step instructions on how to use linear algebra, readily implemented in Python, to compute all objects in play in the tax-smoothing model.

In the calculations below, we’ll set default values of

13.4.1. Step 1#

For a

13.4.2. Step 2#

Compute a constant tax rate

13.4.3. Step 3#

Use the system of equations (13.1) for

To do this, we transform that system of difference equations into a single matrix equation as follows:

Multiply both sides by the inverse of the matrix on the left side to compute

Because we have built into our calculations that the government must satisfy its intertemporal budget constraint and end with zero debt, just barely satisfying the

terminal condition that

Let’s verify this with Python code.

First we implement the model with compute_optimal

def compute_optimal(model, B0, G_seq):

R, S = model.R, model.S

# present value of government expenditures

h0 = model.β_seq @ G_seq # since β = 1/R

# optimal constant tax rate

T0 = (1 - 1/R) / (1 - (1/R)**(S+1)) * (B0 + h0)

T_seq = T0*np.ones(S+1)

A = np.diag(-R*np.ones(S), k=-1) + np.eye(S+1)

b = G_seq - T_seq

b[0] = b[0] + B0

B_seq = np.linalg.inv(A) @ (R * b)

B_seq = np.concatenate([[B0], B_seq])

return T_seq, B_seq, h0

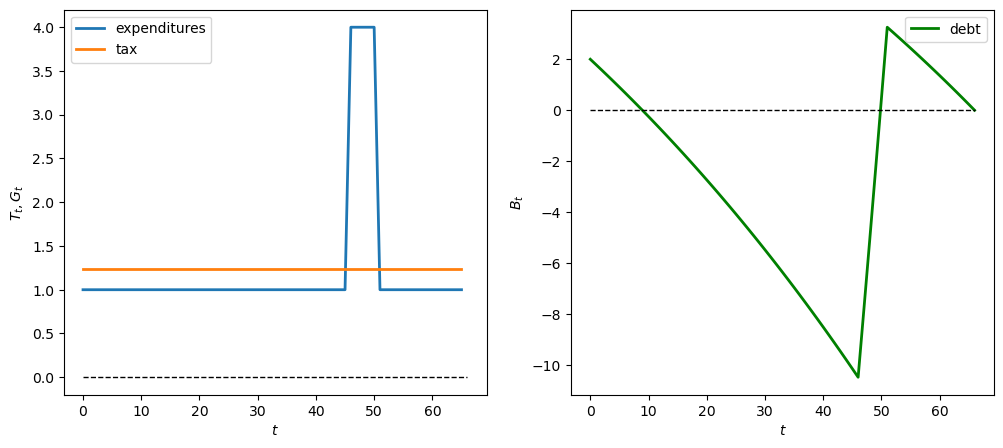

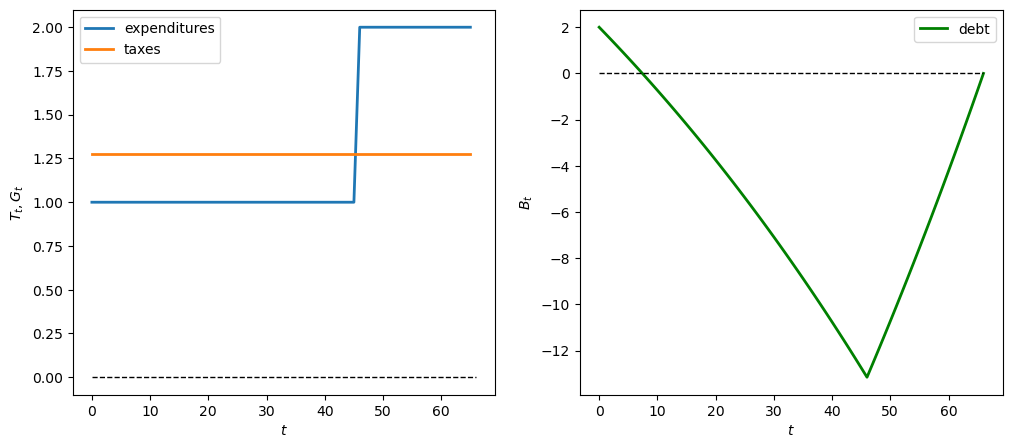

We use an example where the government starts with initial debt

This represents the government’s initial debt burden.

The government expenditure process

The drop in government expenditures could reflect a change in spending requirements or demographic shifts.

# Initial debt

B0 = 2 # initial government debt

# Government expenditure process

G_seq = np.concatenate([np.ones(46), 4*np.ones(5), np.ones(15)])

tax_model = create_tax_smoothing_model()

T_seq, B_seq, h0 = compute_optimal(tax_model, B0, G_seq)

print('check B_S+1=0:',

np.abs(B_seq[-1] - 0) <= 1e-8)

check B_S+1=0: True

The graphs below show paths of government expenditures, tax collections, and government debt.

# Sequence length

S = tax_model.S

fig, axes = plt.subplots(1, 2, figsize=(12,5))

axes[0].plot(range(S+1), G_seq, label='expenditures', lw=2)

axes[0].plot(range(S+1), T_seq, label='tax', lw=2)

axes[1].plot(range(S+2), B_seq, label='debt', color='green', lw=2)

axes[0].set_ylabel(r'$T_t,G_t$')

axes[1].set_ylabel(r'$B_t$')

for ax in axes:

ax.plot(range(S+2), np.zeros(S+2), '--', lw=1, color='black')

ax.legend()

ax.set_xlabel(r'$t$')

plt.show()

Note that

We can evaluate cost criterion (13.2) which measures the total cost / welfare of taxation

def cost(model, T_seq):

β_seq, g1, g2 = model.β_seq, model.g1, model.g2

cost_seq = g1 * T_seq - g2/2 * T_seq**2

return - β_seq @ cost_seq

print('Cost:', cost(tax_model, T_seq))

def welfare(model, T_seq):

return - cost(model, T_seq)

print('Welfare:', welfare(tax_model, T_seq))

Cost: -41.46532630469102

Welfare: 41.46532630469102

13.4.4. Experiments#

In this section we describe how a tax sequence would optimally respond to different sequences of government expenditures.

First we create a function plot_ts that generates graphs for different instances of the tax-smoothing model tax_model.

This will help us avoid rewriting code to plot outcomes for different government expenditure sequences.

def plot_ts(model, # tax-smoothing model

B0, # initial government debt

G_seq # government expenditure process

):

# Compute optimal tax path

T_seq, B_seq, h0 = compute_optimal(model, B0, G_seq)

# Sequence length

S = model.S

fig, axes = plt.subplots(1, 2, figsize=(12,5))

axes[0].plot(range(S+1), G_seq, label='expenditures', lw=2)

axes[0].plot(range(S+1), T_seq, label='taxes', lw=2)

axes[1].plot(range(S+2), B_seq, label='debt', color='green', lw=2)

axes[0].set_ylabel(r'$T_t,G_t$')

axes[1].set_ylabel(r'$B_t$')

for ax in axes:

ax.plot(range(S+2), np.zeros(S+2), '--', lw=1, color='black')

ax.legend()

ax.set_xlabel(r'$t$')

plt.show()

In the experiments below, please study how tax and government debt sequences vary across different sequences for government expenditures.

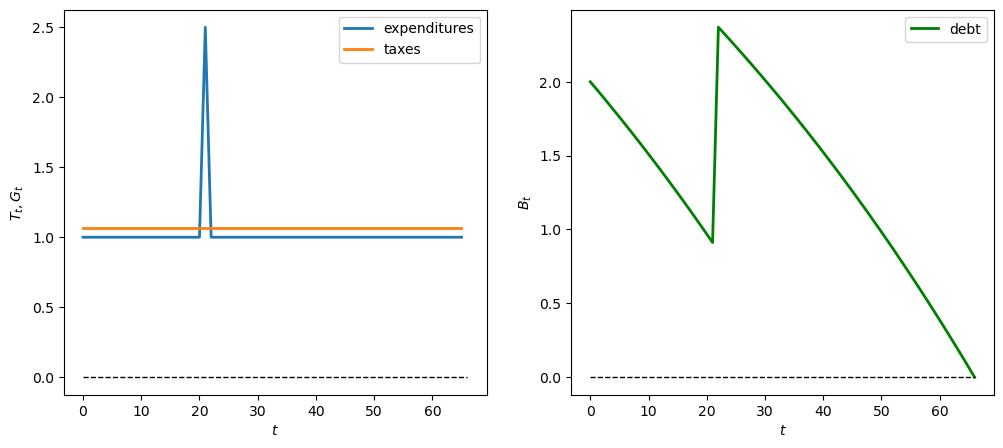

13.4.4.1. Experiment 1: one-time spending shock#

We first assume a one-time spending shock of

We’ll make

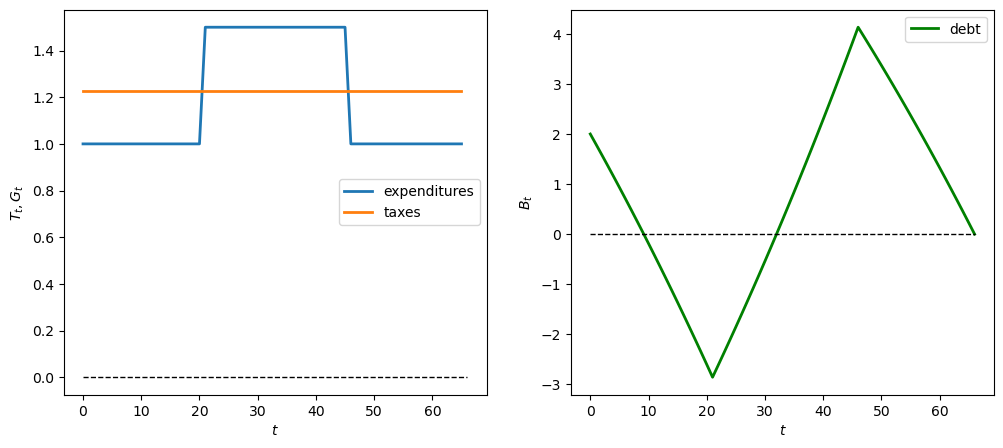

13.4.4.2. Experiment 2: permanent expenditure shift#

Now we assume a permanent increase in government expenditures of

Again we can study positive and negative cases

# Positive temporary expenditure shift L = 0.5 when t >= 21

G_seq_pos = np.concatenate(

[np.ones(21), 1.5*np.ones(25), np.ones(20)])

plot_ts(tax_model, B0, G_seq_pos)

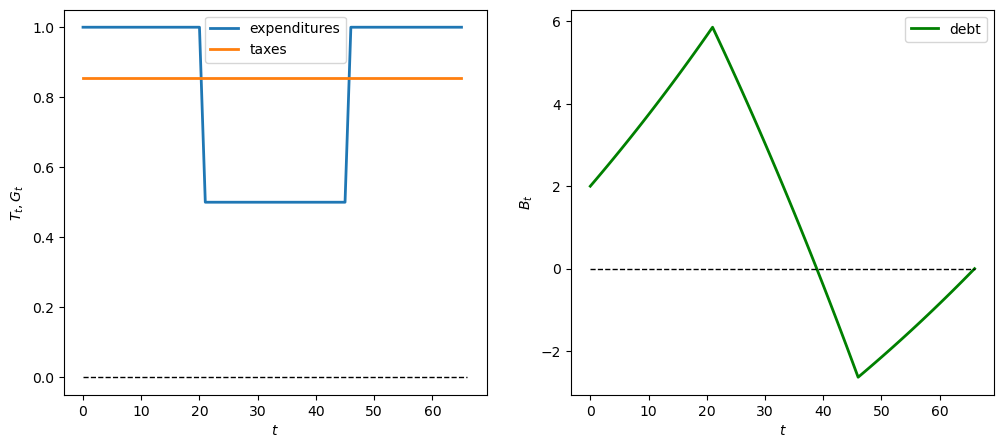

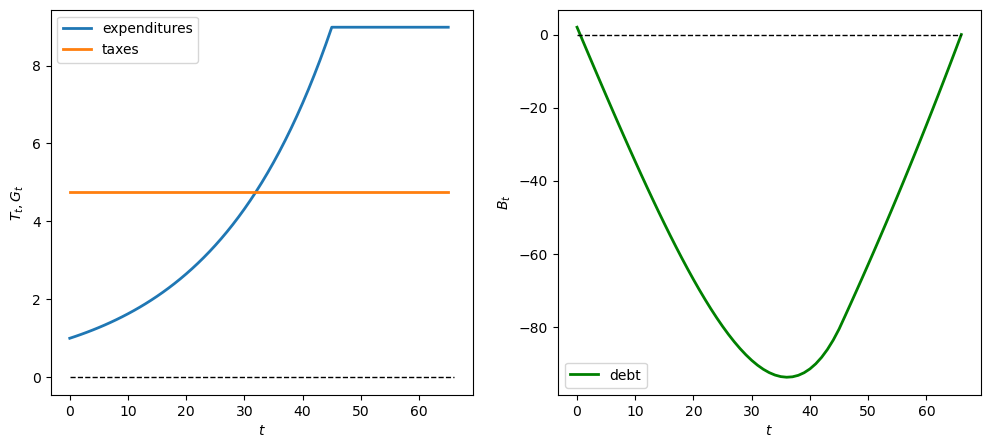

13.4.4.3. Experiment 3: delayed spending surge#

Now we simulate a

13.4.4.4. Experiment 4: growing expenditures#

Now we simulate a geometric

We first experiment with

# Geometric growth parameters where λ = 1.05

λ = 1.05

G_0 = 1

t_max = 46

# Generate geometric G sequence

geo_seq = λ ** np.arange(t_max) * G_0

G_seq_geo = np.concatenate(

[geo_seq, np.max(geo_seq)*np.ones(20)])

plot_ts(tax_model, B0, G_seq_geo)

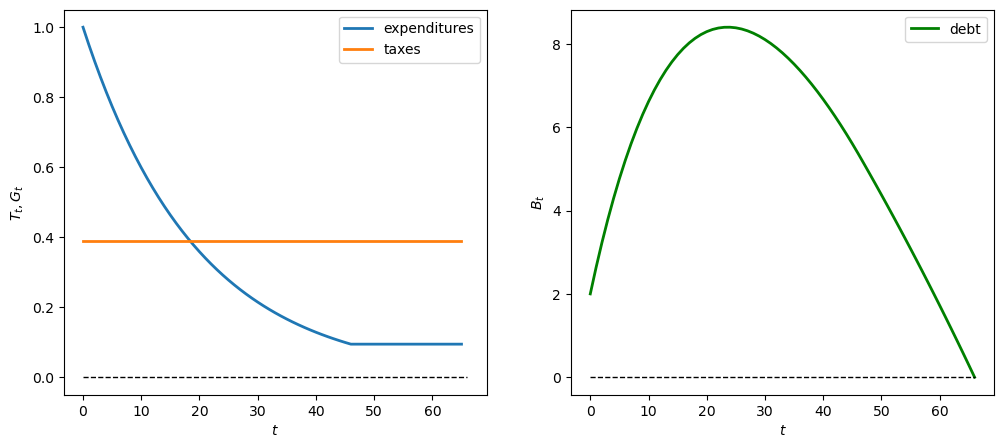

Now we show the behavior when

λ = 0.95

geo_seq = λ ** np.arange(t_max) * G_0

G_seq_geo = np.concatenate(

[geo_seq, λ ** t_max * np.ones(20)])

plot_ts(tax_model, B0, G_seq_geo)

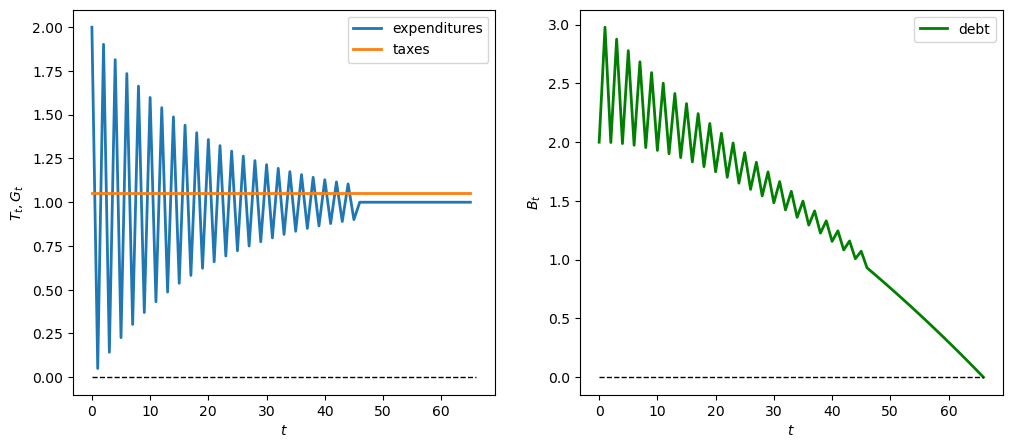

What happens with oscillating expenditures

13.4.5. Feasible Tax Variations#

We promised to justify our claim that a constant tax rate

Let’s do that now.

The approach we’ll take is an elementary example of the “calculus of variations”.

Let’s dive in and see what the key idea is.

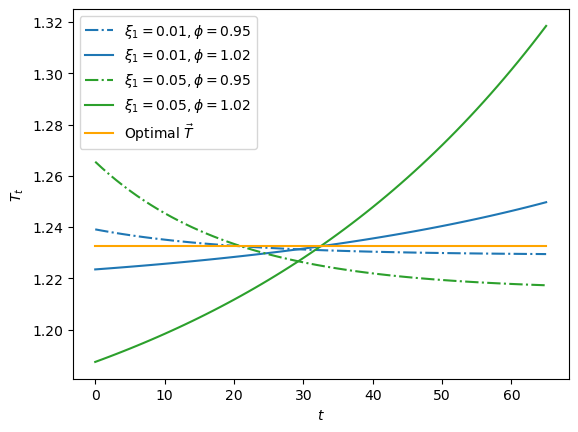

To explore what types of tax paths are cost-minimizing / welfare-improving, we shall create an admissible tax path variation sequence

This equation says that the present value of admissible tax path variations must be zero.

So once again, we encounter a formula for the present value:

we require that the present value of tax path variations be zero to maintain budget balance.

Here we’ll restrict ourselves to a two-parameter class of admissible tax path variations of the form

We say two and not three-parameter class because

Let’s compute that function.

We require

which implies that

which implies that

which implies that

This is our formula for

Key Idea: if

Given

Now let’s compute and plot tax path variations

def compute_variation(model, ξ1, ϕ, B0, G_seq, verbose=1):

R, S, β_seq = model.R, model.S, model.β_seq

ξ0 = ξ1*((1 - 1/R) / (1 - (1/R)**(S+1))) * ((1 - (ϕ/R)**(S+1)) / (1 - ϕ/R))

v_seq = np.array([(ξ1*ϕ**t - ξ0) for t in range(S+1)])

if verbose == 1:

print('check feasible:', np.isclose(β_seq @ v_seq, 0))

T_opt, _, _ = compute_optimal(model, B0, G_seq)

Tvar_seq = T_opt + v_seq

return Tvar_seq

We visualize variations for

fig, ax = plt.subplots()

ξ1s = [.01, .05]

ϕs= [.95, 1.02]

colors = {.01: 'tab:blue', .05: 'tab:green'}

params = np.array(np.meshgrid(ξ1s, ϕs)).T.reshape(-1, 2)

wel_opt = welfare(tax_model, T_seq)

for i, param in enumerate(params):

ξ1, ϕ = param

print(f'variation {i}: ξ1={ξ1}, ϕ={ϕ}')

Tvar_seq = compute_variation(model=tax_model,

ξ1=ξ1, ϕ=ϕ, B0=B0,

G_seq=G_seq)

print(f'welfare={welfare(tax_model, Tvar_seq)}')

print(f'welfare < optimal: {welfare(tax_model, Tvar_seq) < wel_opt}')

print('-'*64)

if i % 2 == 0:

ls = '-.'

else:

ls = '-'

ax.plot(range(S+1), Tvar_seq, ls=ls,

color=colors[ξ1],

label=fr'$\xi_1 = {ξ1}, \phi = {ϕ}$')

plt.plot(range(S+1), T_seq,

color='orange', label=r'Optimal $\vec{T}$ ')

plt.legend()

plt.xlabel(r'$t$')

plt.ylabel(r'$T_t$')

plt.show()

variation 0: ξ1=0.01, ϕ=0.95

check feasible: True

welfare=41.46523217108914

welfare < optimal: True

----------------------------------------------------------------

variation 1: ξ1=0.01, ϕ=1.02

check feasible: True

welfare=41.46467728803246

welfare < optimal: True

----------------------------------------------------------------

variation 2: ξ1=0.05, ϕ=0.95

check feasible: True

welfare=41.46297296464396

welfare < optimal: True

----------------------------------------------------------------

variation 3: ξ1=0.05, ϕ=1.02

check feasible: True

welfare=41.44910088822694

welfare < optimal: True

----------------------------------------------------------------

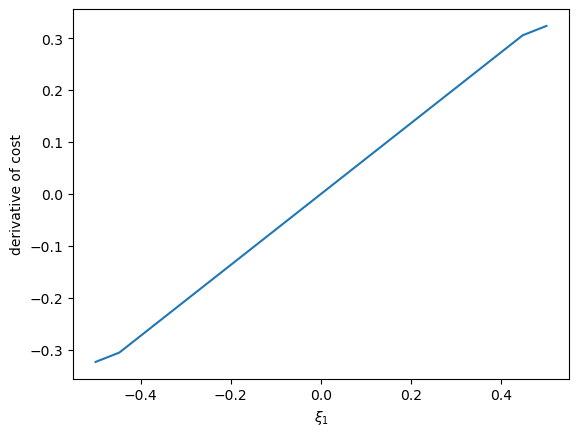

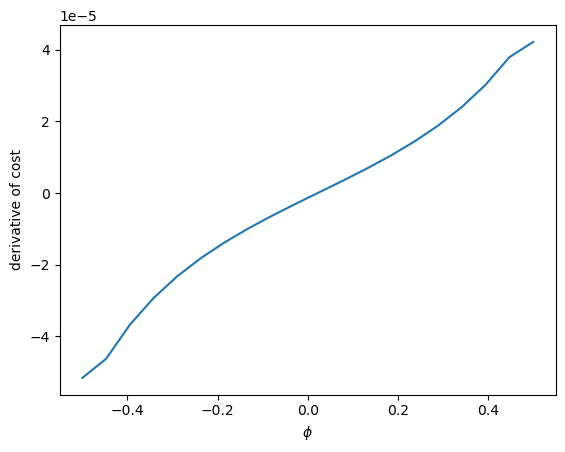

We can even use the Python np.gradient command to compute derivatives of cost with respect to our two parameters.

We are teaching the key idea beneath the calculus of variations.

First, we define the cost with respect to

def cost_rel(ξ1, ϕ):

"""

Compute cost of variation sequence

for given ϕ, ξ1 with a tax-smoothing model

"""

Tvar_seq = compute_variation(tax_model, ξ1=ξ1,

ϕ=ϕ, B0=B0,

G_seq=G_seq,

verbose=0)

return cost(tax_model, Tvar_seq)

# Vectorize the function to allow array input

cost_vec = np.vectorize(cost_rel)

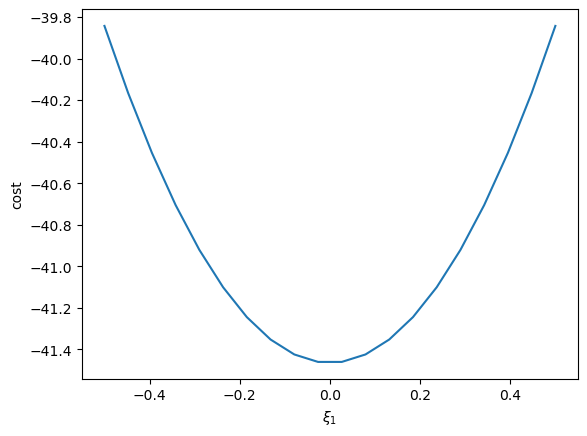

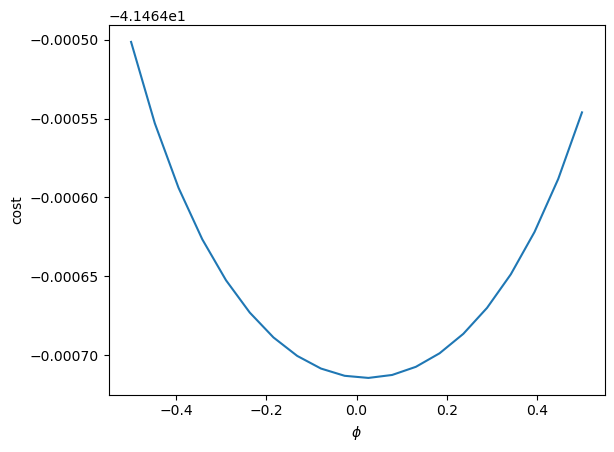

Then we can visualize the relationship between cost and

ξ1_arr = np.linspace(-0.5, 0.5, 20)

plt.plot(ξ1_arr, cost_vec(ξ1_arr, 1.02))

plt.ylabel('cost')

plt.xlabel(r'$\xi_1$')

plt.show()

cost_grad = cost_vec(ξ1_arr, 1.02)

cost_grad = np.gradient(cost_grad)

plt.plot(ξ1_arr, cost_grad)

plt.ylabel('derivative of cost')

plt.xlabel(r'$\xi_1$')

plt.show()

The same can be done on