7. Introduction to Supply and Demand#

7.1. Overview#

This lecture is about some models of equilibrium prices and quantities, one of the core topics of elementary microeconomics.

Throughout the lecture, we focus on models with one good and one price.

See also

In a subsequent lecture we will investigate settings with many goods.

7.1.1. Why does this model matter?#

In the 15th, 16th, 17th and 18th centuries, mercantilist ideas held sway among most rulers of European countries.

Exports were regarded as good because they brought in bullion (gold flowed into the country).

Imports were regarded as bad because bullion was required to pay for them (gold flowed out).

This zero-sum view of economics was eventually overturned by the work of the classical economists such as Adam Smith and David Ricardo, who showed how freeing domestic and international trade can enhance welfare.

There are many different expressions of this idea in economics.

This lecture discusses one of the simplest: how free adjustment of prices can maximize a measure of social welfare in the market for a single good.

7.1.2. Topics and infrastructure#

Key infrastructure concepts that we will encounter in this lecture are:

inverse demand curves

inverse supply curves

consumer surplus

producer surplus

integration

social welfare as the sum of consumer and producer surpluses

the relationship between equilibrium quantity and social welfare optimum

In our exposition we will use the following Python imports.

import numpy as np

import matplotlib.pyplot as plt

from collections import namedtuple

7.2. Consumer surplus#

Before we look at the model of supply and demand, it will be helpful to have some background on (a) consumer and producer surpluses and (b) integration.

(If you are comfortable with both topics you can jump to the next section.)

7.2.1. A discrete example#

Example 7.1

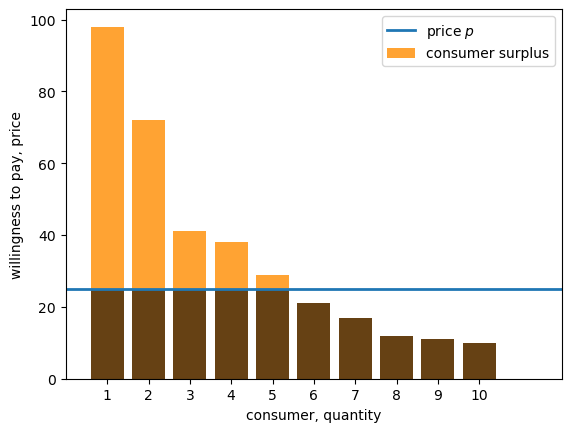

Regarding consumer surplus, suppose that we have a single good and 10 consumers.

These 10 consumers have different preferences; in particular, the amount they would be willing to pay for one unit of the good differs.

Suppose that the willingness to pay for each of the 10 consumers is as follows:

consumer |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

|---|---|---|---|---|---|---|---|---|---|---|

willing to pay |

98 |

72 |

41 |

38 |

29 |

21 |

17 |

12 |

11 |

10 |

(We have ordered consumers by willingness to pay, in descending order.)

If

Note

If

The consumer surplus of the

if

if

For example, if the price is

The bar graph below shows the surplus of each consumer when

The total height of each bar

The orange portion of some of the bars shows consumer surplus.

fig, ax = plt.subplots()

consumers = range(1, 11) # consumers 1,..., 10

# willingness to pay for each consumer

wtp = (98, 72, 41, 38, 29, 21, 17, 12, 11, 10)

price = 25

ax.bar(consumers, wtp, label="consumer surplus", color="darkorange", alpha=0.8)

ax.plot((0, 12), (price, price), lw=2, label="price $p$")

ax.bar(consumers, [min(w, price) for w in wtp], color="black", alpha=0.6)

ax.set_xlim(0, 12)

ax.set_xticks(consumers)

ax.set_ylabel("willingness to pay, price")

ax.set_xlabel("consumer, quantity")

ax.legend()

plt.show()

Fig. 7.1 Willingness to pay (discrete)#

The total consumer surplus in this market is

Since consumer surplus

Later we will pursue this idea further, considering how different prices lead to different welfare outcomes for consumers and producers.

7.2.2. A comment on quantity.#

Notice that in the figure, the horizontal axis is labeled “consumer, quantity”.

We have added “quantity” here because we can read the number of units sold from this axis, assuming for now that there are sellers who are willing to sell as many units as the consumers demand, given the current market price

In this example, consumers 1 to 5 buy, and the quantity sold is 5.

Below we drop the assumption that sellers will provide any amount at a given price and study how this changes outcomes.

7.2.3. A continuous approximation#

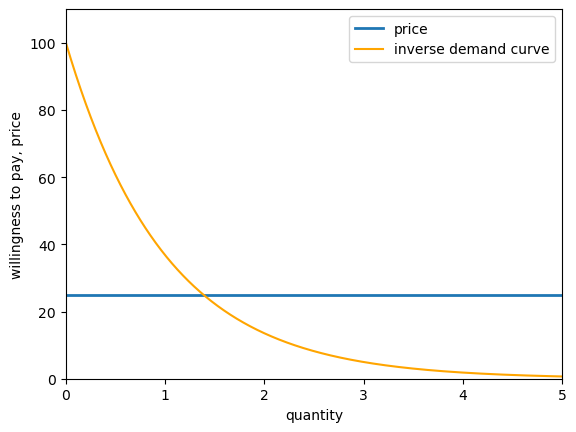

It is often convenient to assume that there is a “very large number” of consumers, so that willingness to pay becomes a continuous curve.

As before, the vertical axis measures willingness to pay, while the horizontal axis measures quantity.

This kind of curve is called an inverse demand curve

An example is provided below, showing both an inverse demand curve and a set price.

The inverse demand curve is given by

def inverse_demand(q):

return 100 * np.exp(- q)

# build a grid to evaluate the function at different values of q

q_min, q_max = 0, 5

q_grid = np.linspace(q_min, q_max, 1000)

# plot the inverse demand curve

fig, ax = plt.subplots()

ax.plot((q_min, q_max), (price, price), lw=2, label="price")

ax.plot(q_grid, inverse_demand(q_grid),

color="orange", label="inverse demand curve")

ax.set_ylabel("willingness to pay, price")

ax.set_xlabel("quantity")

ax.set_xlim(q_min, q_max)

ax.set_ylim(0, 110)

ax.legend()

plt.show()

Fig. 7.2 Willingness to pay (continuous)#

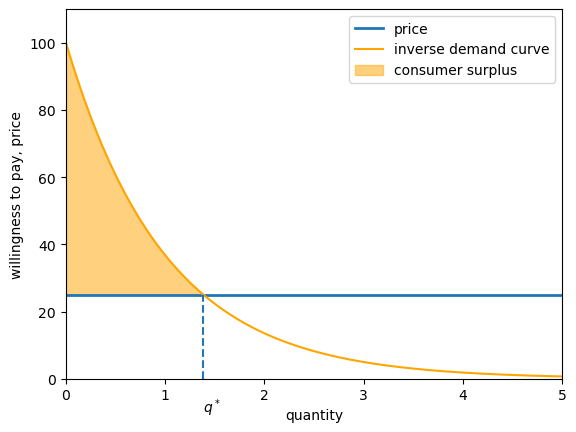

Reasoning by analogy with the discrete case, the area under the demand curve and above the price is called the consumer surplus, and is a measure of total gains from trade on the part of consumers.

The consumer surplus is shaded in the figure below.

# solve for the value of q where demand meets price

q_star = np.log(100) - np.log(price)

fig, ax = plt.subplots()

ax.plot((q_min, q_max), (price, price), lw=2, label="price")

ax.plot(q_grid, inverse_demand(q_grid),

color="orange", label="inverse demand curve")

small_grid = np.linspace(0, q_star, 500)

ax.fill_between(small_grid, np.full(len(small_grid), price),

inverse_demand(small_grid), color="orange",

alpha=0.5, label="consumer surplus")

ax.vlines(q_star, 0, price, ls="--")

ax.set_ylabel("willingness to pay, price")

ax.set_xlabel("quantity")

ax.set_xlim(q_min, q_max)

ax.set_ylim(0, 110)

ax.text(q_star, -10, "$q^*$")

ax.legend()

plt.show()

Fig. 7.3 Willingness to pay (continuous) with consumer surplus#

The value

7.3. Producer surplus#

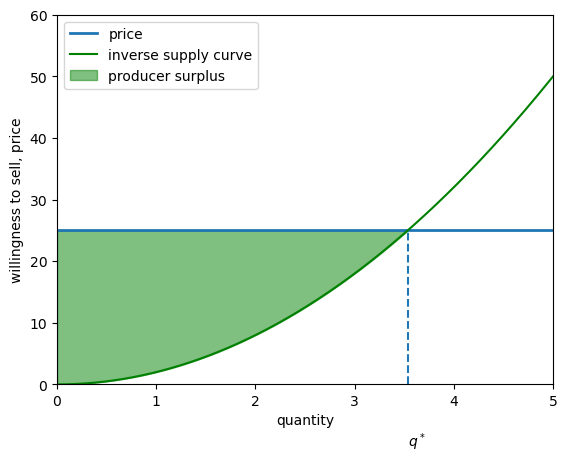

Having discussed demand, let’s now switch over to the supply side of the market.

7.3.1. The discrete case#

The figure below shows the price at which a collection of producers, also numbered 1 to 10, are willing to sell one unit of the good in question

fig, ax = plt.subplots()

producers = range(1, 11) # producers 1,..., 10

# willingness to sell for each producer

wts = (5, 8, 17, 22, 35, 39, 46, 57, 88, 91)

price = 25

ax.bar(producers, wts, label="willingness to sell", color="green", alpha=0.5)

ax.set_xlim(0, 12)

ax.set_xticks(producers)

ax.set_ylabel("willingness to sell")

ax.set_xlabel("producer")

ax.legend()

plt.show()

Fig. 7.4 Willingness to sell (discrete)#

Let

When the price is

Example 7.2

For example, a producer willing to sell at $10 and selling at price $20 makes a surplus of $10.

Total producer surplus is given by

As for the consumer case, it can be helpful for analysis if we approximate producer willingness to sell into a continuous curve.

This curve is called the inverse supply curve

We show an example below where the inverse supply curve is

The shaded area is the total producer surplus in this continuous model.

def inverse_supply(q):

return 2 * q**2

# solve for the value of q where supply meets price

q_star = (price / 2)**(1/2)

# plot the inverse supply curve

fig, ax = plt.subplots()

ax.plot((q_min, q_max), (price, price), lw=2, label="price")

ax.plot(q_grid, inverse_supply(q_grid),

color="green", label="inverse supply curve")

small_grid = np.linspace(0, q_star, 500)

ax.fill_between(small_grid, inverse_supply(small_grid),

np.full(len(small_grid), price),

color="green",

alpha=0.5, label="producer surplus")

ax.vlines(q_star, 0, price, ls="--")

ax.set_ylabel("willingness to sell, price")

ax.set_xlabel("quantity")

ax.set_xlim(q_min, q_max)

ax.set_ylim(0, 60)

ax.text(q_star, -10, "$q^*$")

ax.legend()

plt.show()

Fig. 7.5 Willingness to sell (continuous) with producer surplus#

7.4. Integration#

How can we calculate the consumer and producer surplus in the continuous case?

The short answer is: by using integration.

Some readers will already be familiar with the basics of integration.

For those who are not, here is a quick introduction.

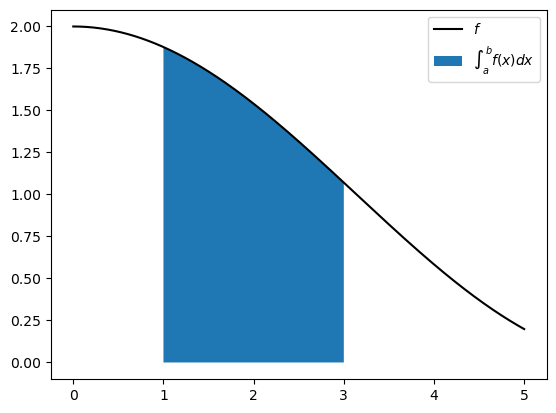

In general, for a function

This value is written as

def f(x):

return np.cos(x/2) + 1

xmin, xmax = 0, 5

a, b = 1, 3

x_grid = np.linspace(xmin, xmax, 1000)

ab_grid = np.linspace(a, b, 400)

fig, ax = plt.subplots()

ax.plot(x_grid, f(x_grid), label="$f$", color="k")

ax.fill_between(ab_grid, [0] * len(ab_grid), f(ab_grid),

label=r"$\int_a^b f(x) dx$")

ax.legend()

plt.show()

Fig. 7.6 Area under the curve#

There are many rules for calculating integrals, with different rules applying to different choices of

Many of these rules relate to one of the most beautiful and powerful results in all of mathematics: the fundamental theorem of calculus.

We will not try to cover these ideas here, partly because the subject is too big, and partly because you only need to know one rule for this lecture, stated below.

If

In fact this rule is so simple that it can be calculated from elementary geometry – you might like to try by graphing

We use this rule repeatedly in what follows.

7.5. Supply and demand#

Let’s now put supply and demand together.

This leads us to the all important notion of market equilibrium, and from there onto a discussion of equilibria and welfare.

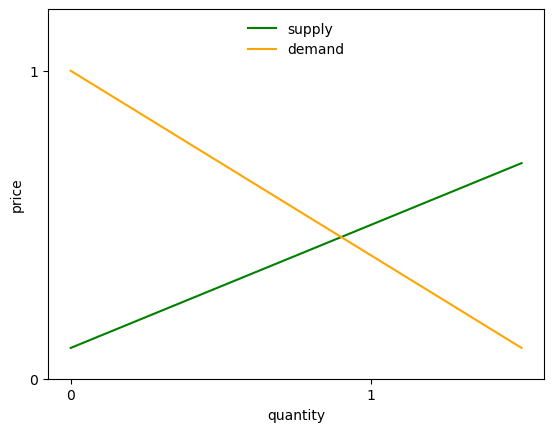

For most of this discussion, we’ll assume that inverse demand and supply curves are affine functions of quantity.

Note

“Affine” means “linear plus a constant” and here is a nice discussion about it.

We’ll also assume affine inverse supply and demand functions when we study models with multiple consumption goods in our subsequent lecture.

We do this in order to simplify the exposition and enable us to use just a few tools from linear algebra, namely, matrix multiplication and matrix inversion.

We study a market for a single good in which buyers and sellers exchange a quantity

Quantity

We assume that inverse demand and supply curves for the good are:

We call them inverse demand and supply curves because price is on the left side of the equation rather than on the right side as it would be in a direct demand or supply function.

We can use a namedtuple to store the parameters for our single good market.

Market = namedtuple('Market', ['d_0', # demand intercept

'd_1', # demand slope

's_0', # supply intercept

's_1'] # supply slope

)

The function below creates an instance of a Market namedtuple with default values.

def create_market(d_0=1.0, d_1=0.6, s_0=0.1, s_1=0.4):

return Market(d_0=d_0, d_1=d_1, s_0=s_0, s_1=s_1)

This market can then be used by our inverse_demand and inverse_supply functions.

def inverse_demand(q, model):

return model.d_0 - model.d_1 * q

def inverse_supply(q, model):

return model.s_0 + model.s_1 * q

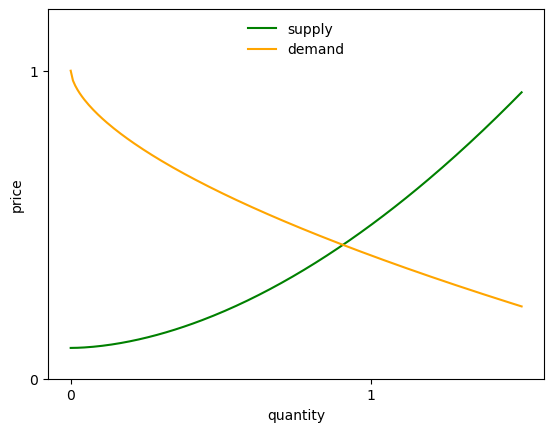

Here is a plot of these two functions using market.

market = create_market()

grid_min, grid_max, grid_size = 0, 1.5, 200

q_grid = np.linspace(grid_min, grid_max, grid_size)

supply_curve = inverse_supply(q_grid, market)

demand_curve = inverse_demand(q_grid, market)

fig, ax = plt.subplots()

ax.plot(q_grid, supply_curve, label='supply', color='green')

ax.plot(q_grid, demand_curve, label='demand', color='orange')

ax.legend(loc='upper center', frameon=False)

ax.set_ylim(0, 1.2)

ax.set_xticks((0, 1))

ax.set_yticks((0, 1))

ax.set_xlabel('quantity')

ax.set_ylabel('price')

plt.show()

Fig. 7.7 Supply and demand#

In the above graph, an equilibrium price-quantity pair occurs at the intersection of the supply and demand curves.

7.5.1. Consumer surplus#

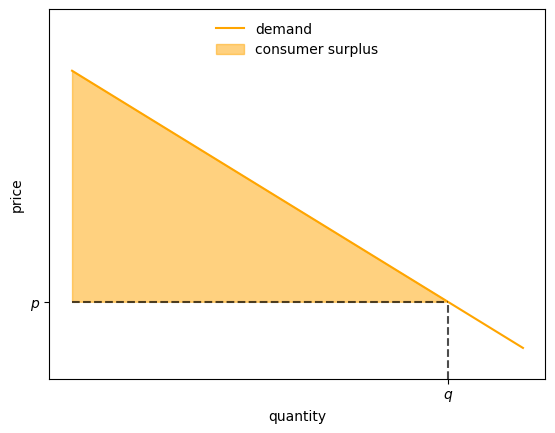

Let a quantity

We define consumer surplus

The next figure illustrates

Show source

q = 1.25

p = inverse_demand(q, market)

ps = np.ones_like(q_grid) * p

fig, ax = plt.subplots()

ax.plot(q_grid, demand_curve, label='demand', color='orange')

ax.fill_between(q_grid[q_grid <= q],

demand_curve[q_grid <= q],

ps[q_grid <= q],

label='consumer surplus',

color="orange",

alpha=0.5)

ax.vlines(q, 0, p, linestyle="dashed", color='black', alpha=0.7)

ax.hlines(p, 0, q, linestyle="dashed", color='black', alpha=0.7)

ax.legend(loc='upper center', frameon=False)

ax.set_ylim(0, 1.2)

ax.set_xticks((q,))

ax.set_xticklabels(("$q$",))

ax.set_yticks((p,))

ax.set_yticklabels(("$p$",))

ax.set_xlabel('quantity')

ax.set_ylabel('price')

plt.show()

Fig. 7.8 Supply and demand (consumer surplus)#

Consumer surplus provides a measure of total consumer welfare at quantity

The idea is that the inverse demand curve

The difference between willingness to pay and the actual price is consumer surplus.

The value

Evaluating the integral in the definition of consumer surplus (7.1) gives

7.5.2. Producer surplus#

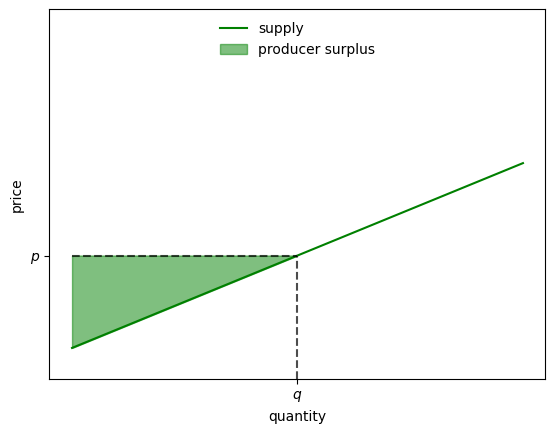

Let a quantity

We define producer surplus as

The next figure illustrates

Show source

q = 0.75

p = inverse_supply(q, market)

ps = np.ones_like(q_grid) * p

fig, ax = plt.subplots()

ax.plot(q_grid, supply_curve, label='supply', color='green')

ax.fill_between(q_grid[q_grid <= q],

supply_curve[q_grid <= q],

ps[q_grid <= q],

label='producer surplus',

color="green",

alpha=0.5)

ax.vlines(q, 0, p, linestyle="dashed", color='black', alpha=0.7)

ax.hlines(p, 0, q, linestyle="dashed", color='black', alpha=0.7)

ax.legend(loc='upper center', frameon=False)

ax.set_ylim(0, 1.2)

ax.set_xticks((q,))

ax.set_xticklabels(("$q$",))

ax.set_yticks((p,))

ax.set_yticklabels(("$p$",))

ax.set_xlabel('quantity')

ax.set_ylabel('price')

plt.show()

Fig. 7.9 Supply and demand (producer surplus)#

Producer surplus measures total producer welfare at quantity

The idea is similar to that of consumer surplus.

The inverse supply curve

The difference between willingness to sell and the actual price is producer surplus.

The value

Evaluating the integral in the definition of producer surplus (7.2) gives

7.5.4. Competitive equilibrium#

Instead of equating quantities supplied and demanded, we can accomplish the same thing by equating demand price to supply price:

If we solve the equation defined by the second equality in the above line for

This is the competitive equilibrium quantity.

Observe that the equilibrium quantity equals the same

The outcome that the quantity determined by equation (7.3) equates supply to demand brings us a key finding:

a competitive equilibrium quantity maximizes our welfare criterion

This is a version of the first fundamental welfare theorem,

It also brings a useful competitive equilibrium computation strategy:

after solving the welfare problem for an optimal quantity, we can read a competitive equilibrium price from either supply price or demand price at the competitive equilibrium quantity

7.6. Generalizations#

In a later lecture, we’ll derive generalizations of the above demand and supply curves from other objects.

Our generalizations will extend the preceding analysis of a market for a single good to the analysis of

In addition

we’ll derive demand curves from a consumer problem that maximizes a utility function subject to a budget constraint.

we’ll derive supply curves from the problem of a producer who is price taker and maximizes his profits minus total costs that are described by a cost function.

7.7. Exercises#

Suppose now that the inverse demand and supply curves are modified to take the form

All parameters are positive, as before.

Exercise 7.1

Use the same Market namedtuple that holds the parameter values as before but

make new inverse_demand and inverse_supply functions to match these new definitions.

Then plot the inverse demand and supply curves

Solution to Exercise 7.1

Let’s update the inverse_demand and inverse_supply functions, as defined above.

def inverse_demand(q, model):

return model.d_0 - model.d_1 * q**0.6

def inverse_supply(q, model):

return model.s_0 + model.s_1 * q**1.8

Here is a plot of inverse supply and demand.

grid_min, grid_max, grid_size = 0, 1.5, 200

q_grid = np.linspace(grid_min, grid_max, grid_size)

market = create_market()

supply_curve = inverse_supply(q_grid, market)

demand_curve = inverse_demand(q_grid, market)

fig, ax = plt.subplots()

ax.plot(q_grid, supply_curve, label='supply', color='green')

ax.plot(q_grid, demand_curve, label='demand', color='orange')

ax.legend(loc='upper center', frameon=False)

ax.set_ylim(0, 1.2)

ax.set_xticks((0, 1))

ax.set_yticks((0, 1))

ax.set_xlabel('quantity')

ax.set_ylabel('price')

plt.show()

Exercise 7.2

As before, consumer surplus at

Here

Producer surplus is price times quantity minus the area under the inverse supply curve:

Here

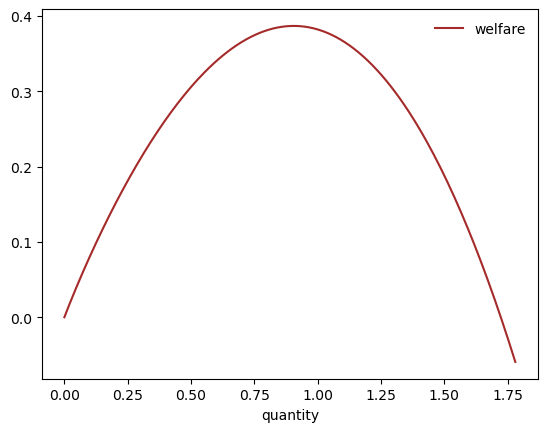

Social welfare is the sum of consumer and producer surplus under the assumption that the price is the same for buyers and sellers:

Solve the integrals and write a function to compute this quantity numerically

at given

Plot welfare as a function of

Solution to Exercise 7.2

Solving the integrals gives

Here’s a Python function that computes this value:

def W(q, market):

# Compute and return welfare

S_c = market.d_0 * q - market.d_1 * q**1.6 / 1.6

S_p = market.s_0 * q + market.s_1 * q**2.8 / 2.8

return S_c - S_p

The next figure plots welfare as a function of

Exercise 7.3

Due to non-linearities, the new welfare function is not easy to maximize with pencil and paper.

Maximize it using scipy.optimize.minimize_scalar instead.

See also

Our SciPy lecture has a section on Optimization is a useful resource to find out more.

Solution to Exercise 7.3

from scipy.optimize import minimize_scalar

def objective(q):

return -W(q, market)

result = minimize_scalar(objective, bounds=(0, 10))

print(result.message)

Solution found.

maximizing_q = result.x

print(f"{maximizing_q: .5f}")

0.90564

Exercise 7.4

Now compute the equilibrium quantity by finding the price that equates supply and demand.

You can do this numerically by finding the root of the excess demand function

You can use scipy.optimize.newton to compute the root.

See also

Our SciPy lecture has a section on Roots and Fixed Points is a useful resource to find out more.

Initialize newton with a starting guess somewhere close to 1.0.

(Similar initial conditions will give the same result.)

You should find that the equilibrium price agrees with the welfare maximizing price, in line with the first fundamental welfare theorem.

Solution to Exercise 7.4

from scipy.optimize import newton

def excess_demand(q):

return inverse_demand(q, market) - inverse_supply(q, market)

equilibrium_q = newton(excess_demand, 0.99)

print(f"{equilibrium_q: .5f}")

0.90564

7.5.3. Social welfare#

Sometimes economists measure social welfare by a welfare criterion that equals consumer surplus plus producer surplus, assuming that consumers and producers pay the same price:

Evaluating the integrals gives

Here is a Python function that evaluates this social welfare at a given quantity

The next figure plots welfare as a function of

Show source Hide code cell source

Fig. 7.10 Welfare#

Let’s now give a social planner the task of maximizing social welfare.

To compute a quantity that maximizes the welfare criterion, we differentiate

Solving for

Let’s remember the quantity

We’ll compare it to the quantity that emerges in a competitive equilibrium that equates supply to demand.